To have potential housebuyers, deciding on what sort of home loan is good to suit your economic demands and you can requires try a vital part of the house to invest in process. Perhaps one of the most well-known mortgage models among financial borrowers try old-fashioned loans. And also make an informed to shop for decision, it is helpful to understand what a traditional mortgage loan try additionally the additional positives various traditional fund items can offer.

A conventional loan is a type of home mortgage that is perhaps not covered or protected from the government. As an alternative, the mortgage is actually supported by personal loan providers, and home insurance is often reduced by the borrowers.

Conventional finance is actually classified in order to conforming and you can low-compliant loans. Most loans was conforming, meaning that they meet the requirements and you can recommendations built of the Fannie Mae and Freddie Mac. Federal national mortgage association and you will Freddy Mac computer is actually regulators sponsored companies (GSEs) one get mortgages from lenders to offer to traders.

Non-Compliant Financing are loans you to which do not conform to GSE assistance. They might be, jumbo Money, collection loans, and you may low-accredited home loan (Non QM) finance.

Understanding the different types of conventional loan alternatives will help possible homebuyers get the right mortgage for their to get needs. The two categories of conventional financing was:

- Fixed Speed Home loan(FRM) Loans: That loan with an intention speed that closed in the application processes. A fixed-rate home mortgage does not change-over the life span of the loan.

- Adjustable Rates Home loan (ARM) Loans: Financing who’s got a varying rate of interest that may go up otherwise fall. Usually, adjustable price mortgage loans features less interest rate versus FRMs not it transform shortly after just as much as four to 7 many years into life of the loan.

Can be a fixed speed home loan rise?

A fixed rate home mortgage, inclusive of the interest and you may principal fee, is actually locked in for the life of the mortgage. The interest rate of a fixed price homeloan payment does not transform, not, good homeowner’s overall mortgage payment get improve some over the years owed in order to movement within the homebuyer’s premium otherwise i need a lot of money now change with the house’s possessions income tax.

Exactly what are the great things about a predetermined-speed antique home loan?

The main advantage of a predetermined-rates financial is the fact that debtor was protected from sudden otherwise significant increases in their monthly home loan repayments. Of many homebuyers feel comfortable which have a fixed-speed antique home mortgage because they can without difficulty discover the commission requirements based on the time of the mortgage. Fixed-rate financing program variables and you will qualification requirements may differ a little regarding bank so you’re able to lender.

A regular antique financing downpayment are 20%, but it’s possible to acquire a traditional mortgage with shorter than simply 20% down. There are several antique financing software that enable individuals which satisfy particular requirements to help you be considered which have only step three% down.

Is a good jumbo financing a traditional financing?

A great jumbo financing try low-conforming conventional loan. Which loan is recognized as non-conforming because it’s not backed by a federal government agencies. Good jumbo financing often is familiar with let possible customers finance quality features which could go beyond the newest qualifications to have a traditional conforming financing. To help you qualify for an excellent jumbo conventional loan, new Government Housing Administration (FHA) requires the possessions possess a worth of over $ $484,350. Jumbo fund are only for sale in certain U.S. counties. These fund usually want highest down costs and you can minimum credit score away from 720 to help you qualify.

The length of time was an everyday home loan identity?

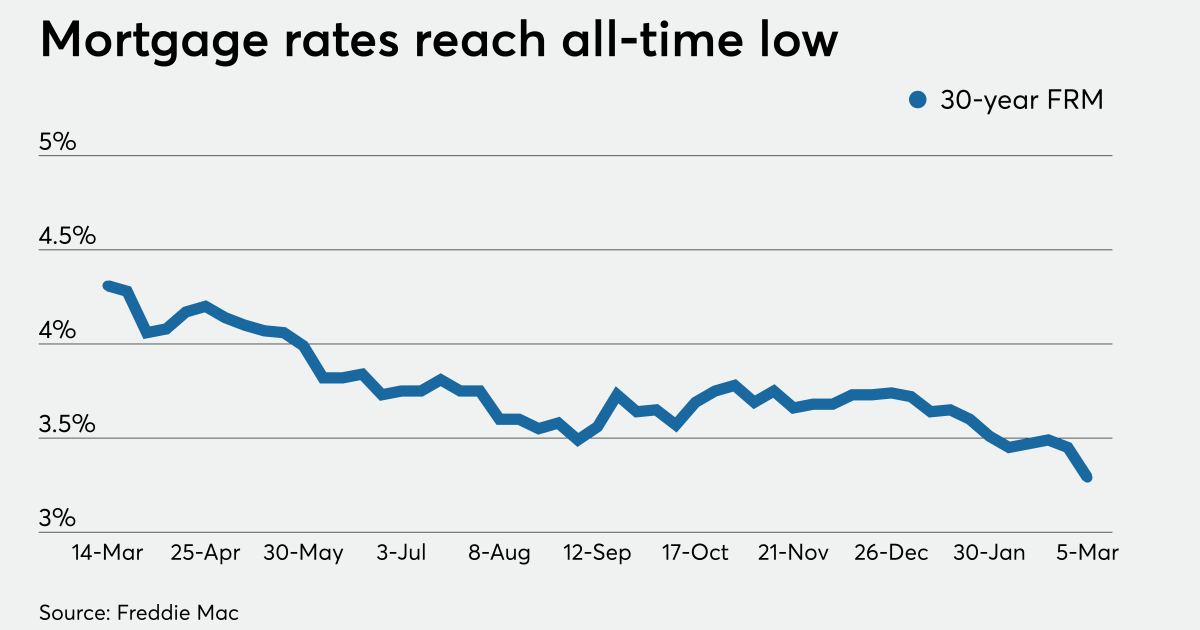

Deciding on the name duration of a normal mortgage is actually a great crucial area of the property procedure. Widely known title to have a normal real estate loan are 30 years. Brand new 31-year-repaired price home loan could have been a mainstay among U.S. homeowners for decades. The brand new 31-seasons FRM normally also offers less payment consequently regarding comprising money more an extended period but tend to has actually a good large interest versus adjustable-rates mortgages (ARMs).

Also the 29-12 months term, 15-seasons mortgages are also available for many different financial factors. Good 15-year mortgage is paid by 50 percent the time because a thirty-season mortgage, although payment is oftentimes highest. For homebuyers seeking beat mortgage personal debt easier, an excellent fifteen-season fixed rate mortgage could help all of them get to men and women monetary wants. When potential house buyers need to safe a traditional financial mortgage, it is very important have all the information. Understanding the types of traditional funds readily available will assist the buyer select the one that fits their requirements and you may financial desires.

Interested in learning about the old-fashioned mortgage options? Click the link to visit Mutual from Omaha Mortgage’s complete set of get financing offerings and then have come now!