- Take note of the qualifications conditions and you will value before getting an effective 2nd possessions.

- Brand new current rise in Most Client’s Stamp Obligation (ABSD) setting you might you desire more cash when purchasing a moment home.

- To buy another possessions includes a great deal more financial obligation; its advised to be obvious regarding your goal for selecting another possessions

Which have rising prices dominating headlines into the present days, rates of interest are set to increase after that regarding coming weeks. If you have been probably and get a moment assets, this can be a good time first off searching since the an effective escalation in interest rate might just imply stabilisation out-of possessions costs.

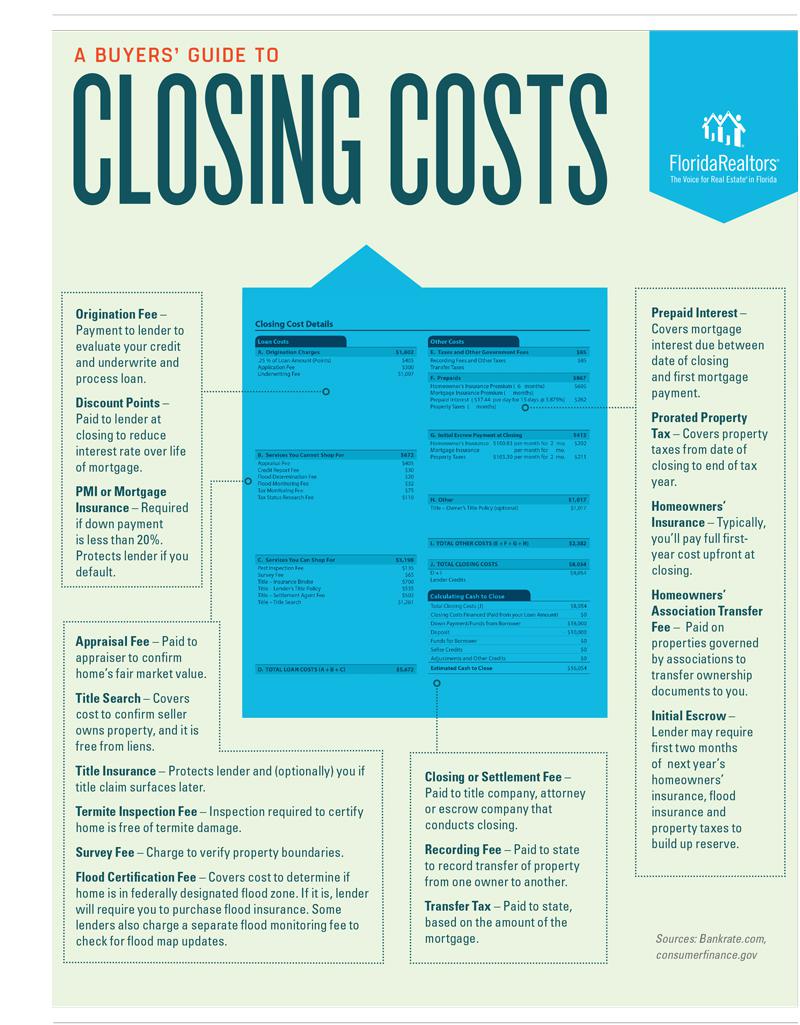

Aside from the expense of the home, there are several things you might must be alert to when purchasing one minute home, such as qualification, cost and purpose.

Qualifications

For many who individual a private property, you will then be free to pick the next private assets without the court implications. However, if for example the first house is a community casing, whether it’s a setup-to-Acquisition (BTO) flat, resale HDB apartment, exec condo (EC), otherwise Construction, Make and sell System (DBSS) flats, then you’ll definitely must fulfil specific criteria prior to your purchase.

HDB apartments come with an effective 5-12 months Minimal Community Several months (MOP) needs, and therefore you might need to occupy you to definitely property to own a good minimum of five years before you could offer otherwise rent your own apartment. Additionally, you will have to fulfil the fresh new MOP through to the get out of an exclusive property.

Create remember that just Singapore owners will be able to own both a keen HDB and you can a private property meanwhile. Singapore Permanent Citizens (PRs) will need to get out of their apartment contained in this six months of one’s individual property get.

Affordability

Attributes are known to getting notoriously costly when you look at the Singapore and you may careful computations should be built to make sure that your 2nd assets pick stays sensible to you personally. You might need to take notice of your own adopting the:

You’d have to pay ABSD once you pick another residential assets. Extent you’d have to pay depends on the reputation.

Brand new ABSD is actually past adjusted on as an element of procedures to help you offer a lasting possessions sector https://paydayloanalabama.com/excel/. Latest costs was mirrored on dining table below:

Considering the most recent ABSD cost, an effective Singapore Citizen who already has an HDB apartment however, wants to buy a personal condominium costing $1 million must spend a keen ABSD off $200,000 (20%). Create keep in mind that which amount is on the upper client’s stamp responsibility.

Your first home purchase demands only around 5% dollars advance payment for folks who took up a bank loan, but your next property need a twenty five% cash down payment of one’s property’s valuation limit. Offered a house that is cherished in the $1 million, you would you desire $250,000 cash for down-payment.

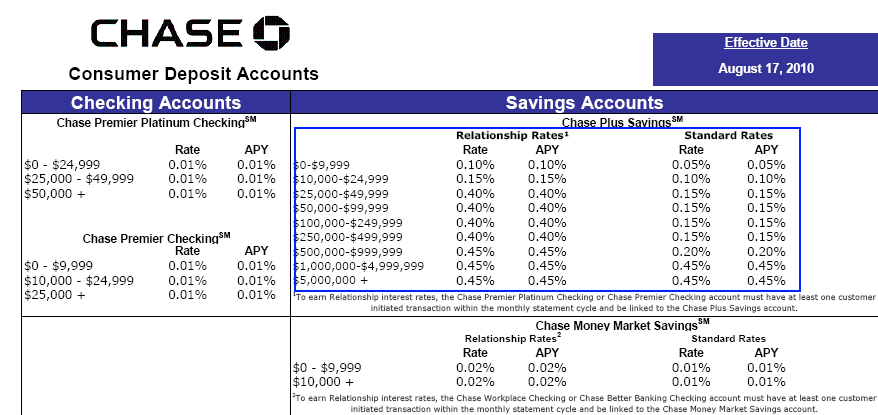

The total Debt Repair Proportion (TDSR) build are produced to stop homebuyers regarding credit too much to invest in the acquisition regarding property. Beneath the structure, home buyers can just only use in order to right up 55% (revised into ) of their disgusting month-to-month money.

For those who have a home loan associated with the first possessions buy, it can considerably impact the count you can borrow for the next domestic. Yet not, if you have currently cleaned the loan on your own earliest household, then you’ll definitely just need to make sure your month-to-month construction financing payments along with every other month-to-month bills dont meet or exceed 55% of your own month-to-month earnings.

For the basic housing financing, youre permitted acquire doing 75% of the property worthy of if you find yourself taking on a mortgage or 55% should your loan period is over three decades or extends prior age 65. For your 2nd construction financing, your loan-to-really worth (LTV) ratio falls in order to forty five% to have mortgage tenures as much as thirty years. In the event your loan tenure exceeds twenty five years otherwise your 65th birthday, your own LTV falls so you’re able to 29%.

As you can plainly see, to get an additional assets when you find yourself however buying the mortgage out-of very first household will need a lot more dollars. Considering a home valuation out-of $1 million, you’ll likely you want:

While it is it is possible to to make use of your own Central Provident Fund (CPF) to buy the second possessions, if you have already utilized their CPF to you basic domestic, you could potentially only use the excess CPF Typical Membership discounts having your second possessions just after putting away the present day Very first Old age Scheme (BRS) out of $96,000.

Intention

Purchasing an additional assets comes with significantly more monetary duty compared to very first you to, and is also informed are obvious regarding the objective having buying the 2nd possessions. Is it to own resource, otherwise will you be utilizing it once the an extra home?

Clarifying their purpose allows you to to make specific conclusion, including the particular possessions, plus opting for an area who would better fit the objective. This can be especially important if the 2nd home is a financial investment property.

Like most most other assets, you’ll need certainly to exercise the possibility local rental produce and you will financing appreciation, in addition to dictate the estimated return on the investment. As the property get is a huge financial support, it’s also advisable to enjoys a technique one to believe facts such as:

What is your investment vista? Would you seek to bring in income immediately after five years, or perhaps to keep they towards enough time-identity to collect book?

When and how do you really clipped losses, or no? If for example the mortgage payments is higher than the reduced local rental earnings, the length of time do you hold on ahead of promoting it well?

Buying property from inside the Singapore is actually funding-extreme and purchasing an additional home will require alot more economic wisdom. Any miscalculation have high financial outcomes. As such, establish a clear bundle and you can demand a wealth thought manager in order to which have you are able to blind locations.

Begin Believe Now

Here are some DBS MyHome to work out the fresh new figures and get a property that fits your financial allowance and you will preferences. The best part it incisions from guesswork.

As an alternative, prepare yourself having a call at-Concept Approval (IPA), so that you enjoys confidence about how precisely far you could obtain to have your residence, allowing you to learn your budget correctly.