The newest Virtual assistant mortgage preapproval techniques is similar to the process of delivering preapproved for other brand of financial, with many important variations. To really make the processes easier, you need to start planning as early as possible. Get ready for the new preapproval processes by doing another:

Submit the COE

Getting Virtual assistant fund, you need to get a beneficial COE guaranteeing that you meet up with the provider requirements because of it types of funding. You could potentially get an effective COE by visiting eBenefits, log in and you can submitting a request.

The requirements to own a beneficial COE count on the sort of provider your completed. Particularly, active-obligations service members would like to get an announcement away from provider and you can have it signed because of the the dominating manager or professionals manager.

According to whenever and just how you served, you may need to render a copy regarding DD-214, an information Declaration otherwise a statement regarding Provider. This type of files assist find out if your meet the lowest service criteria to have a great Va home loan system.

Get monetary records to each other

After you complete a preapproval software, your lender commonly make sure all the information was real. Along with your own COE, they’ll request a number of data files to greatly help make sure everything your considering regarding the money, assets and you can credit history.

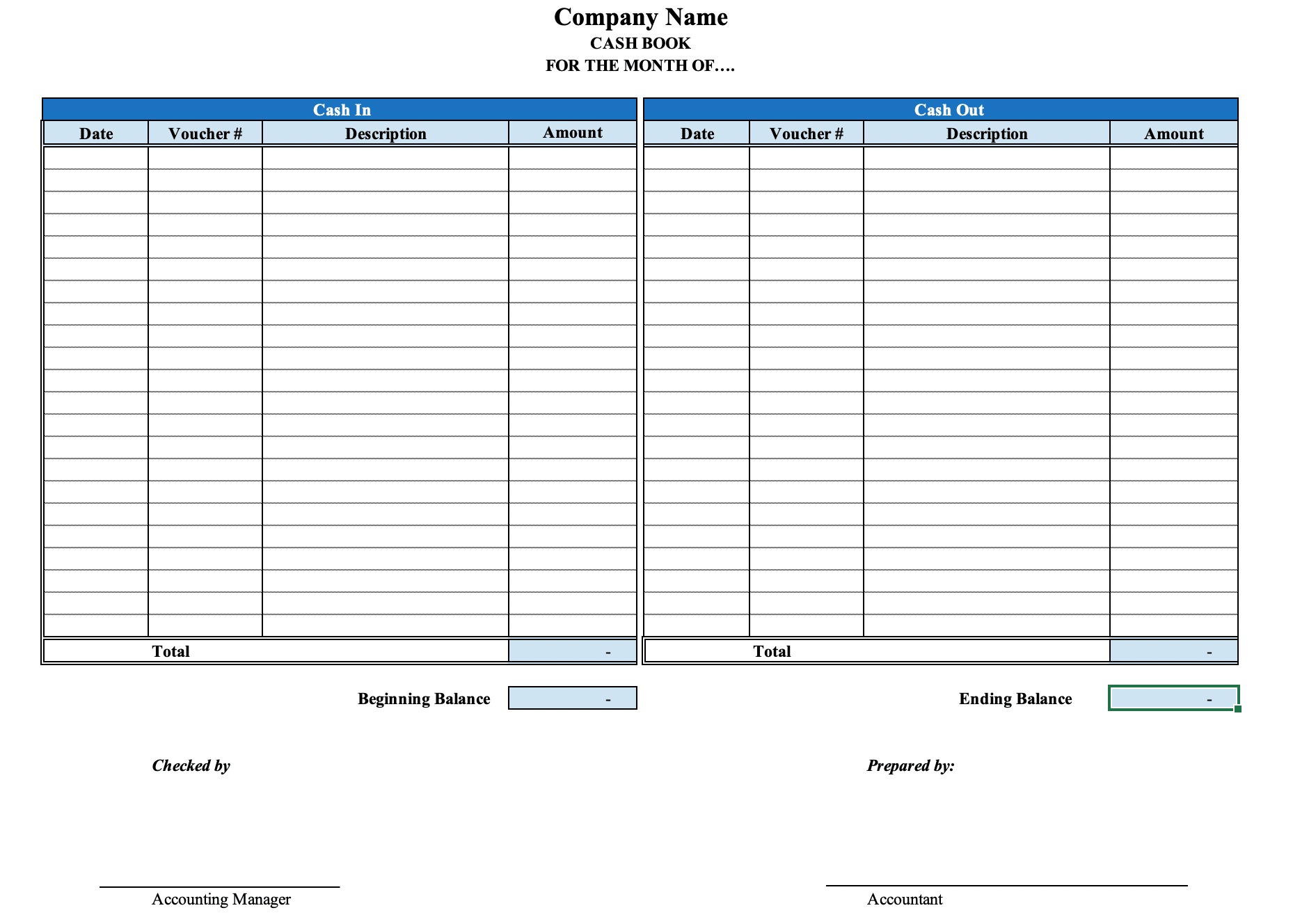

Records You’ll need for Va Financing Preapproval

To verify the identity, your lender need to select a driver’s license and Personal Defense cards. If you don’t have a driver’s license, bring your county-issued photographs ID, a legitimate You.S. passport and other research that you’re a legal citizen.

Most of the called for papers makes reference to your money. Expect you’ll offer copies of just one two months regarding shell out stubs and you can 1 2 yrs regarding W-2 versions and you will taxation statements to aid the lending company be certain that your own earnings. You will also need bank statements and other data files to prove the latest property value the property.

You may also you want evidence of a career, eg a signed letter from your employer, if you’re don’t an assistance representative. If you’re mind-functioning, you’ll need to bring profit-and-loss statements or other records for your needs.

For the preapproval procedure, the lending company gets copies of one’s credit file in the around three big credit reporting agencies. These are typically wanting information regarding your debt weight and you will commission background, and you will any proof of prior foreclosures, bankruptcies, evictions or income tax liens.

Some documents conditions are certain for the factors. When you find yourself separated, such as for instance, you may need to provide a copy of your separation decree. Borrowers with services-linked handicaps should also be willing to give a great Virtual assistant impairment award page, even when their bank commonly verify this to you quite often.

Get a hold of a Virtual assistant bank

Because a reminder, the new Va loan program requires that you use a medication bank. And come up with their can cost you given that manageable as you are able to, one thing to carry out try contrast numerous loan providers considering the stated interest levels and you may fees.

Rates are essential, nevertheless the bank to the reasonable rates isn’t always an informed financial for your needs. If you are rebuilding your borrowing, such, you’ll want to money loans in Birmingham Alabama see a lender which is ready to performs having individuals that lower fico scores.

When you find yourself meeting intel towards possible lenders, don’t forget in the borrowing unions and online alternatives. Conventional banking institutions offer a number of money, but they aren’t the best suits for all.

Complete your own preapproval software

Now, it is time to complete your preapproval application. It’s important which you stick to the instructions with the page. Failing woefully to promote requested guidance may cause preapproval waits and you can make the techniques way more hard than it needs are.