If you get a credit card that provides spectacular rewards or part redemption expertise, watch out such notes have a tendency to feature higher APRs. Should your card offers your cash back towards most of the sales, travel rewards or other higher incentives, you will likely have increased Annual percentage rate so you can be the cause of the individuals payday loans without checking account in Daleville costs.

Area

Area features an impact on your Annual percentage rate too, especially if you get a mortgage. Additional states and you will local governments have differing guidelines that’ll feeling charge or other individuals will set you back you’ll end upwards purchasing, for this reason switching the Annual percentage rate too.

Happening into the Financing Operate (TILA) needs loan providers to disclose the latest Annual percentage rate from that loan or borrowing credit through to the borrower is signal any type of offer. While you are looking around to own credit cards, you need to be able to see initial regarding render exactly what the newest Annual percentage rate of every cards is really you could examine will cost you of different loan providers.

For many who actually have a charge card and you are undecided what your Apr is actually, there are methods for you to learn. It ought to be noted on the monthly statement, you could along with notice it by the signing into the account on the internet and enjoying the information of your own line of credit.

What makes Your own Annual percentage rate High?

For many who featured new Apr on the mastercard otherwise mortgage out-of fascination and you may had been surprised at exactly how large it actually was, you are not by yourself. Of many individuals are perplexed as to the reasons their Annual percentage rate was higher than it imagine it should be. Let’s remark several explanations the speed could well be higher.

Financing Sorts of

For those who have a loan, it may feature a top ple, signature loans such as particular signature loans will often have high APRs while the they’re not backed by whichever security. Secured personal loans, in addition, constantly have straight down APRs as the mortgage is actually backed by an article of your home, such as for example property otherwise car, that is certainly grabbed and you can offered should you fail to generate money.

Credit cards often have large age reasoning once the signature loans: nothing is positioned to prove you will build your money promptly. There are such things as secured playing cards, although not, that enable you to prepay their credit line number to suit your lender to hold once the security. Since your lender has an easy way to recoup its losings, if you end while making repayments, these cards tend to have all the way down APRs.

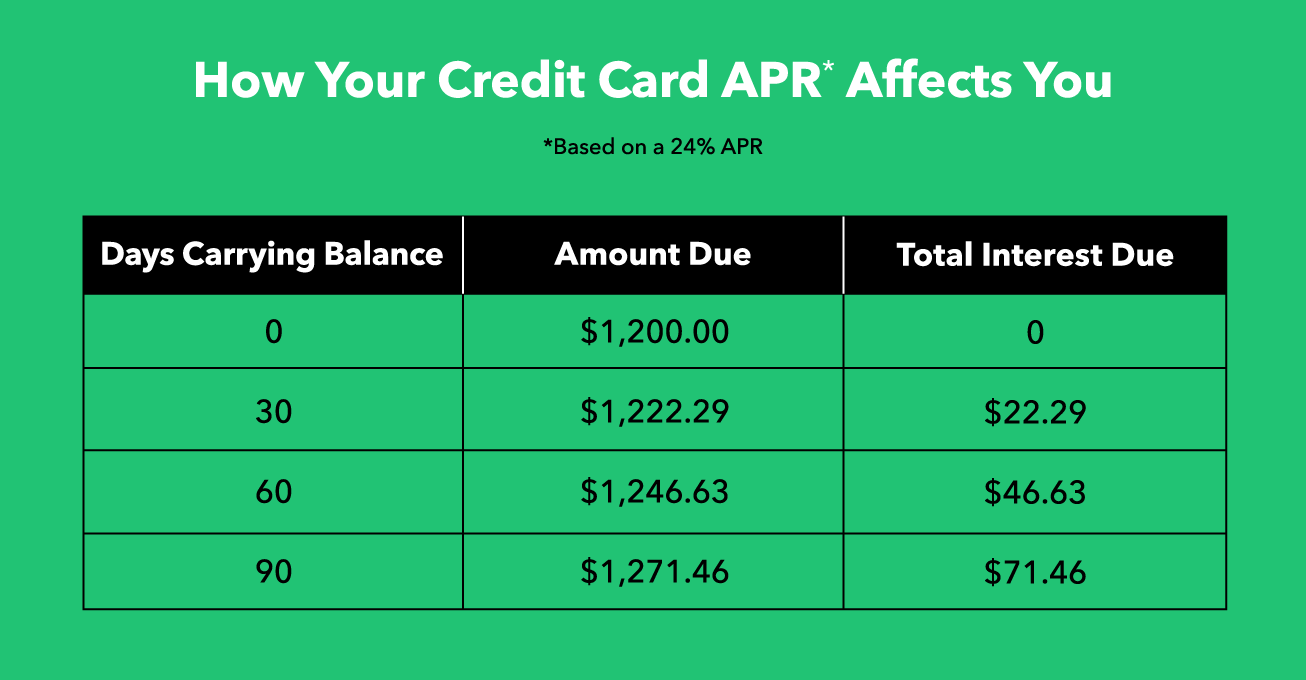

However, charge card pick Annual percentage rate won’t also amount for many who pay your own equilibrium out of completely per month since you won’t be charged towards the a running balance.

Lowest Credit history

When you yourself have incomplete borrowing, your credit rating would be leading to a top Apr. Your credit rating reveals loan providers just how you addressed the money you owe during the for the last, whenever your financial records has been a little rocky, loan providers may only be considered your to have playing cards and you will money which have higher Annual percentage rate while making upwards on credit exposure.

Obligations Weight

Loan providers together with look at the financial obligation-to-earnings ratio, or DTI, to choose their Apr. Their DTI methods exactly how much personal debt you may have when comparing to how much cash you’re taking household at the end of the new day. For those who have excessive personal debt, lenders is generally less willing to allow you to borrow funds due to the fact you are prone to are not able to build repayments. Really loan providers favor your DTI is beneath the 40% assortment, but it’s crucial that you note that the lower the DTI, the low Annual percentage rate you will be offered.