More often than not, you could subtract new entirety of your property financial attract, however the full count relies on the day of the financial, the degree of the mortgage, and how you are by using the proceeds.

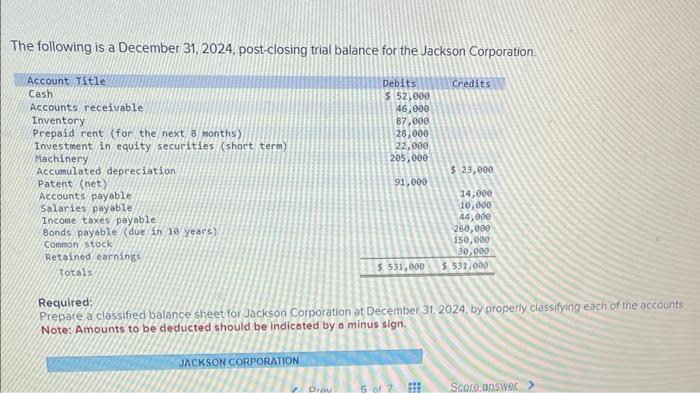

Attract Deduction Constraints

There can be an alternate maximum to be familiar with (at the time of brand new 2018 income tax seasons) to deduct the interest from your restoration domestic equity mortgage.

Having maried people, home loan focus towards a whole prominent all the way to $750,000 of your house equity loan amount can still be deducted, that was shorter out-of $step 1,000,000 pre-income tax reform. To own unmarried homeowners, the new miracle count has become $375,000; down out-of $500,000.

In order long since your amount borrowed doesn’t surpass these types of viewpoints, you can nevertheless deduct the attention paid back. There are many house equity mortgage hand calculators available to you in order to let give you a far greater thought of exacltly what the amount borrowed is.

Whenever you are domestic security financing and house equity personal lines of credit is actually several various other situations, their interest price deduction statutes are exactly the same. If you’re not yes concerning the difference in the 2, you can learn a little more about HELOCs right here, however, here’s the gist:

A home equity mortgage makes you use a lump sum more than a-flat time having a fixed interest rate, if you’re HELOCs are a bit more flexible. Which have a personal line of credit, you have access to the cash thereon credit line on any time in depending mark period (constantly 10 years). The fresh new HELOC even offers changeable interest rates one to pursue market prices, unlike a predetermined-rate household equity financing.

Depending on the Internal revenue service lower than Publication 936, known as Real estate loan-Attract Deduction, you could potentially deduct interest paid down towards the domestic security money when they accustomed pick, build or significantly boost a great taxpayer’s house you to secures the mortgage.

And many home improvements in which residents are employing a home equity loan or HELOC satisfy so it requisite. Your house financial-attract deduction is a type of deduction that may subtract appeal from a first or second financial (home collateral financing) off their taxes, and often considering their personal factors, homeowners tend to decide which channel offers a bigger deduction.

Knowing the Potential Taxation Benefits associated with Their Home improvements Financing

If you find yourself family equity financing and you will household equity personal lines of credit was a couple various other products, one another home collateral loan and HELOC interest tax deductible legislation is actually a comparable. If you’re not yes concerning the difference between the two, you can discover much more about HELOCs here, but right here is the gist:

Property security financing enables you to borrow a lump sum over an appartment period of time which have a predetermined interest, while HELOCs try a bit more versatile. That have a credit line, you have access to the income thereon credit line at the anytime during the oriented mark several months – constantly ten years. New HELOC even offers variable interest rates one realize sector pricing, as opposed to a fixed-rate house equity financing.

For many who complete a property improve endeavor using a property collateral mortgage or HELOC, and additionally RenoFi Domestic Security Funds and RenoFi HELOCs, or are considering doing this, you will be eligible for income tax deductions having home improvements you accomplished.

Facts Family Equity Personal lines of credit (HELOC)

Good HELOC is created as the an excellent revolving line of credit protected by household that allows one to borrow against the fresh new readily available collateral in your home. This has a readily available borrowing limit influenced by your residence’s worthy of, the total amount owed to the mortgage, plus the lender’s standards.

HELOCs in general has actually changeable costs, which means the rates commonly change with respect to the market while the you are paying back the loan installment loans for bad credit in Columbus MS. This is exactly perhaps the biggest downside as it brings the possibility having to pay straight back more your expected from the bank.